Table of Contents

What is ROI?

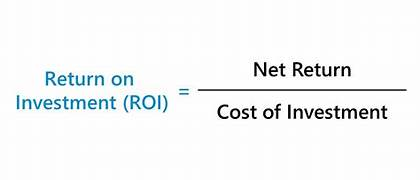

Return on investment (ROI) is a key financial metric that helps evaluate the efficiency of an investment and compare it to others. Simply put, it tells you how much money you stand to make from an investment.

ROI measures how much profit you make from an investment relative to its cost. It’s expressed as a percentage or ratio and helps you determine if your investment is worth it.

“In business, ROI is the ultimate measure of success.” — Unknown

Types of ROI

- Zero ROI: You’ve made money without spending any. This is like free marketing where your time has a financial value. Sometimes, zero ROI can be a win!

- Positive ROI: Your returns are greater than your costs. It’s a good sign that your investment is paying off.

- Negative ROI: Your costs exceed your returns. This means your investment didn’t turn out as expected.

House Flipping example

Let’s say you buy a house for $75,000, spend $35,000 on renovations, and sell it for $160,000. Here’s how you calculate ROI:

- Net Profit: $160,000 (sale) – $110,000 (total spent) = $50,000

- Total Investment: $110,000

- ROI: (50,000110,000)×100=45%\left( \frac{50,000}{110,000} \right) \times 100 = 45\%(110,00050,000)×100=45%

So, your ROI is 45%, showing a nice return on your investment!

How to Boost Your ROI

| Strategy | Details |

|---|---|

| Optimize Timing | Use data to identify peak times for better discounts and conversions. |

| Choose the Best Location | Analyze traffic data to find locations where efforts yield the highest returns. |

| Adjust Premiums | Set different bids or prices to rank higher and attract more attention. |

| Target the Right Crowd | Focus on the audience with the highest click and conversion rates. |

| Pick the Right Platform | Advertise on channels with the best conversion rates. |

| Improve Website Engagement | Aim for a high arrival rate and engagement on your website. |

| Collaborate with Drop Shipping | Partner with drop shipping services to cut costs and expand your reach. |

Companies with Strong ROI

| Company | Industry | ROI |

|---|---|---|

| Apple Inc. | Technology | ~36% |

| Microsoft Corp. | Technology | ~31% |

| Amazon.com, Inc. | E-commerce & Cloud | ~12% |

| Berkshire Hathaway | Conglomerate | ~13% |

| Johnson & Johnson | Healthcare | ~25% |

| Visa Inc. | Financial Services | ~20% |

| Procter & Gamble | Consumer Goods | ~17% |

| NVIDIA Corporation | Technology | ~45% |

| Intel Corporation | Technology | ~20% |

| Coca-Cola Co. | Beverage | ~10% |

“ROI isn’t just about the money you make; it’s about the value you create.”

FAQs

1. What is ROI in simple terms?

ROI, or Return on Investment, measures the profitability of an investment. In simple terms, it’s how much profit you gain from an investment compared to its cost. Think of it as the financial gain or loss resulting from investing a certain amount of money.

2. What ROI rate means?

The ROI rate is a percentage that indicates the efficiency or profitability of an investment. It shows how much return you can expect for every dollar (or other currency unit) you invest. A higher ROI rate means a more profitable investment.

3. How do we calculate ROI?

ROI = Net Profit / Cost of the investment * 100

4. What is a good ROI?

A good ROI depends on the industry and type of investment. Generally, an ROI of 7-10% per year is considered good for stock market investments. However, what’s “good” can vary; for startups, a higher ROI may be expected due to higher risk.

5. What does 20% ROI mean?

A 20% ROI means that for every $100 you invest, you earn $20 in profit. It indicates a healthy return, showing that the investment is generating significant profit compared to its cost.

6. Why is ROI important?

ROI is crucial because it helps investors evaluate the efficiency and profitability of their investments. It allows for easy comparison between different investment opportunities and helps in making informed financial decisions.

7. Is a 100% ROI good?

A 100% ROI is excellent. It means you have doubled your investment. For instance, if you invest $1,000, a 100% ROI means you earn an additional $1,000 in profit, totaling $2,000.

8. Is 7% a good ROI?

A 7% ROI is considered good, especially for long-term investments like stocks or real estate. It indicates steady and reliable growth, often aligning with average market returns.

9. What ROI is high?

An ROI above 20% is typically considered high. Such high returns are often seen in high-risk investments, startups, or real estate deals with significant growth potential. High ROI reflects excellent profitability but may also come with higher risk.

Latest episodes