Table of Contents

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

yep, you’ve probably heard that a million times at the end of those mutual fund ads. It’s just a fancy way of saying that your mutual fund investments can roller-coaster up or nosedive down depending on how the market is feeling. So, no promises you’ll always make money – it could be a jackpot, or it could be a jack-not!

Mutual funds are like a team of people pooling their money to invest in stocks, bonds, or other assets. It’s like putting your money together with others to buy a variety of investments. Let’s break down what this means in plain, simple terms.

What Are Mutual Funds?

Think of mutual funds as a big pot of money collected from many investors who all have similar investment goals. This money is managed by a professional called a fund manager. The fund manager invests this pooled money in different financial securities, like stocks or bonds. When these investments make money, it’s shared among the investors based on how much they’ve invested. This sharing is calculated using something called net asset value, or NAV.

| Type of Fund | Description |

|---|---|

| Large Cap Funds | Invest in large, well-established companies. |

| Mid Cap Funds | Invest in medium-sized companies with growth potential. |

| Small Cap Funds | Invest in smaller companies with high growth potential. |

| Sector Funds | Focus on specific industries like technology or banking. |

- Multicap Funds: They mix it up with a bit of everything – a buffet of investments.

- Balanced Funds: They’re like the zen masters of mutual funds, balancing stocks and bonds for steady growth.

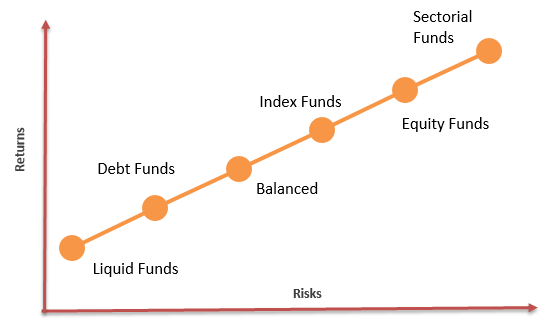

Hey, in life and investments, there’s always a bit of risk involved. The smarter the risk, the bigger the potential reward – just like with jobs.

Top 5 global mutual fund companies:

- Vanguard Group

- BlackRock

- Fidelity Investments

- J.P. Morgan Asset Management

- Franklin Templeton

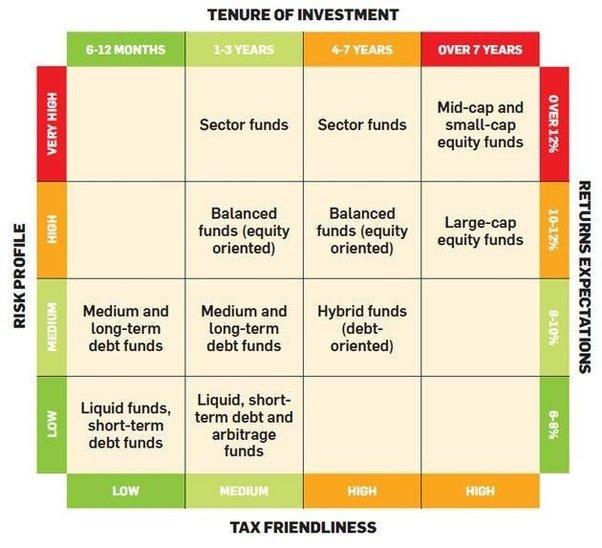

Types of investments

| Investment Type | Approximate Return | Description |

|---|---|---|

| Savings Account (PSU Bank) | 3.5% | Safe and steady returns. |

| Fixed Deposit (Small Private Bank) | 8% | Higher return with relatively low risk. |

| Balanced Mutual Funds | 10–12% | Moderate return with a balanced approach. |

| Multicap Mutual Funds | 14% | Solid growth with diversified investment. |

| Mid-Cap Mutual Funds | 18% | Higher returns with medium-sized companies. |

| Small-Cap Mutual Funds/Sector Funds | 20% or more | High risk, high reward with significant potential returns. |

Remember, the choice depends on your risk appetite and financial goals. Take your pick wisely!

Remember, becoming money smart isn’t just about making bucks – it’s about understanding how money works for you. So, grab a book, learn the ropes, and soon you’ll be the guru of your own financial journey.

You got this! Happy investing!

FAQs

What is a mutual fund in simple words?

A mutual fund is like a big pot where many investors put their money together. This pool of money is then managed by professionals who invest it in a mix of stocks, bonds, or other assets. The goal is to grow your money over time, and you share in the profits (or losses) based on how well the investments perform.

What are 3 types of mutual funds?

- Equity Mutual Funds: Invest mainly in stocks, aiming for higher growth but with more risk.

- Debt Mutual Funds: Invest in bonds and other fixed-income securities, offering lower risk and stable returns.

- Hybrid Mutual Funds: Combine stocks and bonds, balancing potential returns with risk.

How do mutual funds make you money?

Mutual funds make you money through two main ways:

- Dividends: Earnings from stocks or bonds in the fund are distributed to investors.

- Capital Gains: Profit from selling investments at a higher price than purchased is shared with investors.

Are mutual funds a good investment?

Mutual funds can be a good investment, especially if you’re looking for diversification and professional management. They offer a way to invest in a variety of assets without having to pick individual investments yourself. However, it’s essential to choose the right type of mutual fund based on your financial goals and risk tolerance.

Can I get monthly income from mutual funds?

Yes, some mutual funds are designed to provide regular income, such as monthly income plans (MIPs) or dividend-paying funds. These funds distribute a portion of their earnings on a regular basis, providing a steady income stream.

Can I sell my mutual fund anytime?

Yes, you can sell (redeem) your mutual fund shares at any time. The value of your shares will be based on the fund’s net asset value (NAV) at the time of redemption. However, be aware of any exit loads or fees that may apply.

How to get income from mutual funds?

You can receive income from mutual funds through dividends or interest distributions, or by redeeming shares. Some funds pay out earnings regularly, while others reinvest them to help your investment grow. For a steady income, consider funds specifically designed for this purpose.

Is mutual fund SIP safe?

Mutual fund SIPs are generally considered safe, but they carry investment risk, depending on the type of fund. SIPs offer the advantage of spreading investments over time, which reduces the impact of market volatility. Always research and choose a fund that aligns with your risk appetite and investment goals.

Latest episodes

Leave a Reply to Can Astrology Predict Stock Market Crashes? 5 great Planetary Alignments and Market Trends Cancel reply